- Get link

- Other Apps

- Get link

- Other Apps

The concept of money laundering is essential to be understood for these working within the monetary sector. It is a process by which dirty money is transformed into clean cash. The sources of the cash in precise are felony and the money is invested in a method that makes it appear like clean cash and conceal the identification of the prison part of the money earned.

While executing the financial transactions and establishing relationship with the brand new clients or sustaining current customers the responsibility of adopting satisfactory measures lie on each one who is a part of the group. The identification of such ingredient at first is easy to take care of as a substitute realizing and encountering such conditions in a while in the transaction stage. The central financial institution in any country gives complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to deter such situations.

Rather the point of this post is that the case law now being made in the FBAR and offshore account context will have direct application to more traditional Anti-Money Laundering AMLBSA enforcement actions because the civil penalty statute being interpreted in the FBAR cases is the same provision which applies to claimed failures to maintain an adequate AML program and other violations of the BSA. Although relevant to the FDICs interests the primary purpose for utilizing civil money penalties is not to effect remedial action.

FinCEN assessed two significant AML-related civil money penalties in 2016 against a bank and credit union.

Civil penalties for money laundering. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention. The most interesting aspect of this revised assessment is that it allows the casino to reduce its original 8 million penalty by 3 million if it. 982 if a person has been convicted of money laundering any property real or personal involved in the offence or any property traceable to.

Money laundering offenses can also give rise to a civil action under Section 1956. - Agencies can impose civil and criminal penalties for violations of the BSA. Section 1957 carries a maximum penalty of ten years in prison and maximum fine of 250000 or twice the value of the transaction.

Both sections 31 USC 5318 Compliance exemptions and summons authority and 31 USC 5318A are viewed as complementary international counter money laundering provisions and share the same penalty 31 USC 5321a7 Penalties for International Counter Money Laundering Violations. Criminal Penalties for Money Laundering Terrorist Financing and Violations of the BSA Penalties for money laundering and terrorist financing can be severe. Under Chapter 9A83 RCW MONEY LAUNDERING Complete Chapter 9A83020 Money laundering money laundering is a class B felony leading to up to 10 years imprisonment.

There is no civil penalty provision. And for a violation of 18 USC 1956 a 3 an undetermined fine or imprisonment of up to 20 years or both. The most significant difference from 1956 prosecutions is the intent requirement.

The criminal penalty for a violation of 18 USC 1956 a 1 and 2 is a fine of up to 500000 or twice the value of the monetary instruments involved whichever is greater or imprisonment of up to 20 years or both. Civil money penalties are assessed not only to punish the violator according to the degree of culpability and severity of the violation but also to deter future violations. A conviction for money laundering under Proceeds of Crime Act section 327 to 329 can result in a prison sentence of up to 14 years a fine or both.

Additionally civil penalties of twice the value of the amount involved and payment of attorney fees is also imposed. Youll have to pay a 1500 penalty administration charge as well as the penalty for breaches of the Money Laundering Regulations such as failures for. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 Civil Penalty Regulations Published on.

From a civil standpoint the potential penalty is usually 10000 or the value of financial transaction in question whichever is greater. There is both criminal forfeiture following a conviction for money laundering and civil forfeiture against the assets involved in or traceable to money laundering criminal conduct. A civil money penalty in an amount equal to not less than 2 times the amount of the transaction but not.

Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 Guidance Note This guidance note is relevant to any person listed in paragraph 26a to r of Schedule 4 to the Proceeds of Crime Act 2008 Issued. Such action in the form of restitution or other corrective measures should be separately pursued. First FinCEN and the Office of the Comptroller of the Currency announced a combined 4 million civil money penalty against Gibraltar Private Bank and Trust Company for allegedly willfully violating the AML requirements of the BSA.

04 July 2019 Following a public consultation in early 2019 the Civil Penalty Regulations have now been brought into force. - The BSA requires financial institutions to have an anti -money laundering compliance program and comply with a number of reporting and recordkeeping requirements. FinCEN announced on May 3 2018 that Artichoke Joes a card club and casino located in San Bruno California and founded in 1916 has entered into a revised civil money penalty assessment regarding alleged deficiencies under the Bank Secrecy Act BSA.

Restitution and Civil Money Penalties Section 8b6A of the FDI Act grants the FDIC authority to issue ceaseand- -desist orders requiring an IAP or IDI to make restitution to the institution consumers or the FDIC as receiver. State banking agencies can impose similar penalties. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000.

Https Www Ppatk Go Id Backend Assets Uploads 20200221111540 Pdf

Pdf Anti Money Laundering Regulations And Its Effectiveness

Anti Money Laundering 2021 The Anti Money Laundering Act Of 2020 S Corporate Transparency Act Iclg

What Is Money Laundering Explained Examples Schemes Regulations Money Laundering Money Investing

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Anti Money Laundering International Law And Practice Wiley

What Are The Three Stages Of Money Laundering

Hong Kong Fx Broker Clsa Faces New Zealand Aml Probe Anti Money Laundering Law Fx Broker New Zealand

Money Laundering Money Laundering Financial Action Task Force On Money Laundering

Criminals Are Lining Their Pockets Without Effective Eu Anti Money Laundering Rules Socialists Democrats

Anti Money Laundering And Counter Terrorism Financing Law And Policy Showcasing Australia Brill

Money Laundering What Are The Obligated Subjects

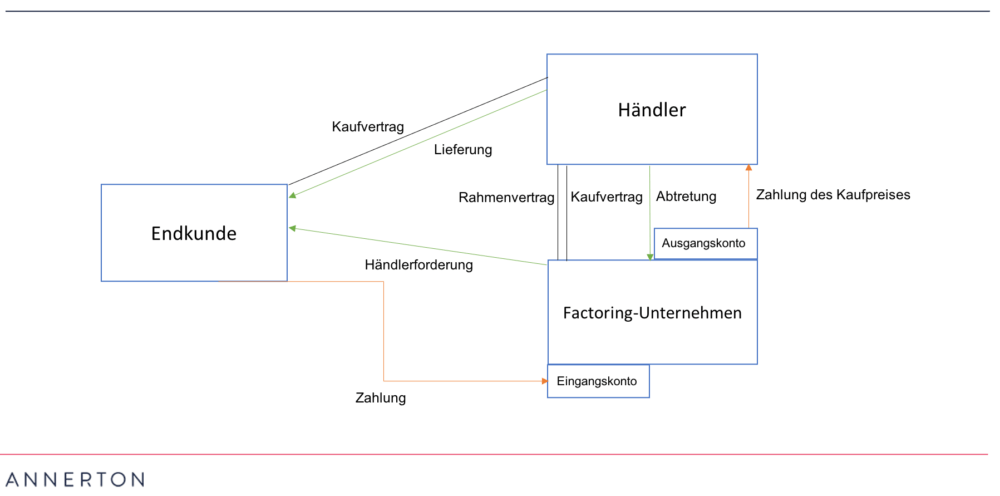

Factoring And Anti Money Laundering Law

Newt Gingrich On Twitter Mueller Is Setting Up A Dragnet Of Obstruction Financial Questions And Every Aspect Of Trump S Money Laundering Prison Humor Money

The world of laws can appear to be a bowl of alphabet soup at times. US cash laundering laws are no exception. We've got compiled a list of the top ten money laundering acronyms and their definitions. TMP Danger is consulting agency targeted on protecting monetary providers by decreasing danger, fraud and losses. Now we have large bank experience in operational and regulatory danger. We've a robust background in program management, regulatory and operational danger as well as Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many adverse penalties to the organization as a result of risks it presents. It will increase the chance of major dangers and the chance value of the bank and in the end causes the financial institution to face losses.

Comments

Post a Comment