- Get link

- Other Apps

- Get link

- Other Apps

The idea of money laundering is very important to be understood for those working within the financial sector. It is a course of by which soiled money is transformed into clear cash. The sources of the money in precise are felony and the money is invested in a method that makes it appear to be clean cash and conceal the id of the legal part of the cash earned.

While executing the financial transactions and establishing relationship with the new prospects or maintaining existing clients the obligation of adopting sufficient measures lie on every one who is part of the organization. The identification of such aspect in the beginning is straightforward to deal with as a substitute realizing and encountering such situations later on in the transaction stage. The central bank in any country gives full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to discourage such situations.

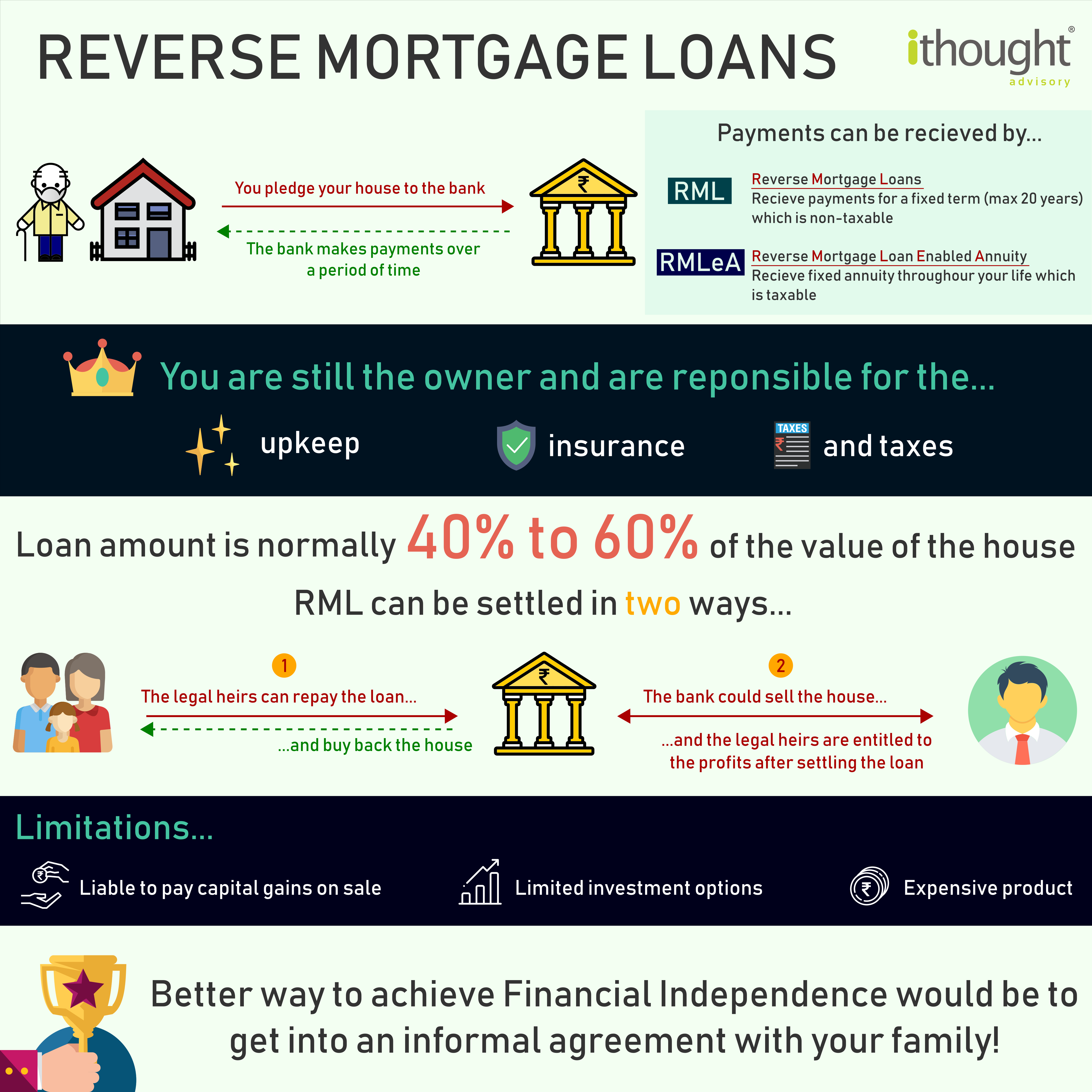

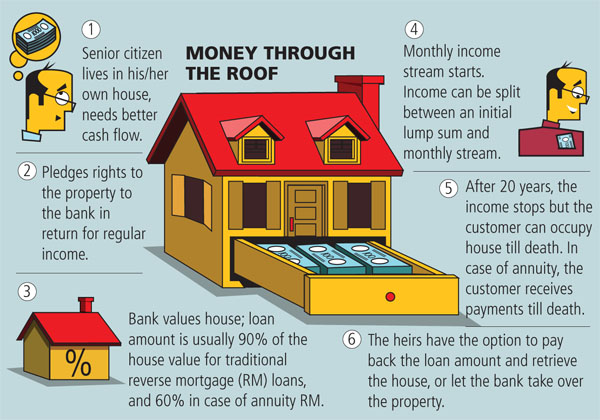

The lender can be authorized to sell the home to settle the loan balance. 25 Use Savings or Other Assets to Pay Off the Reverse Mortgage.

Reverse Mortgage Loan Enabled Annuity Rmlea A Better Option Over Reverse Mortgage Loan Rml Mymoneysage Blog

Our Terms of Use Agreement Privacy Policy and to receive important notices and other communications.

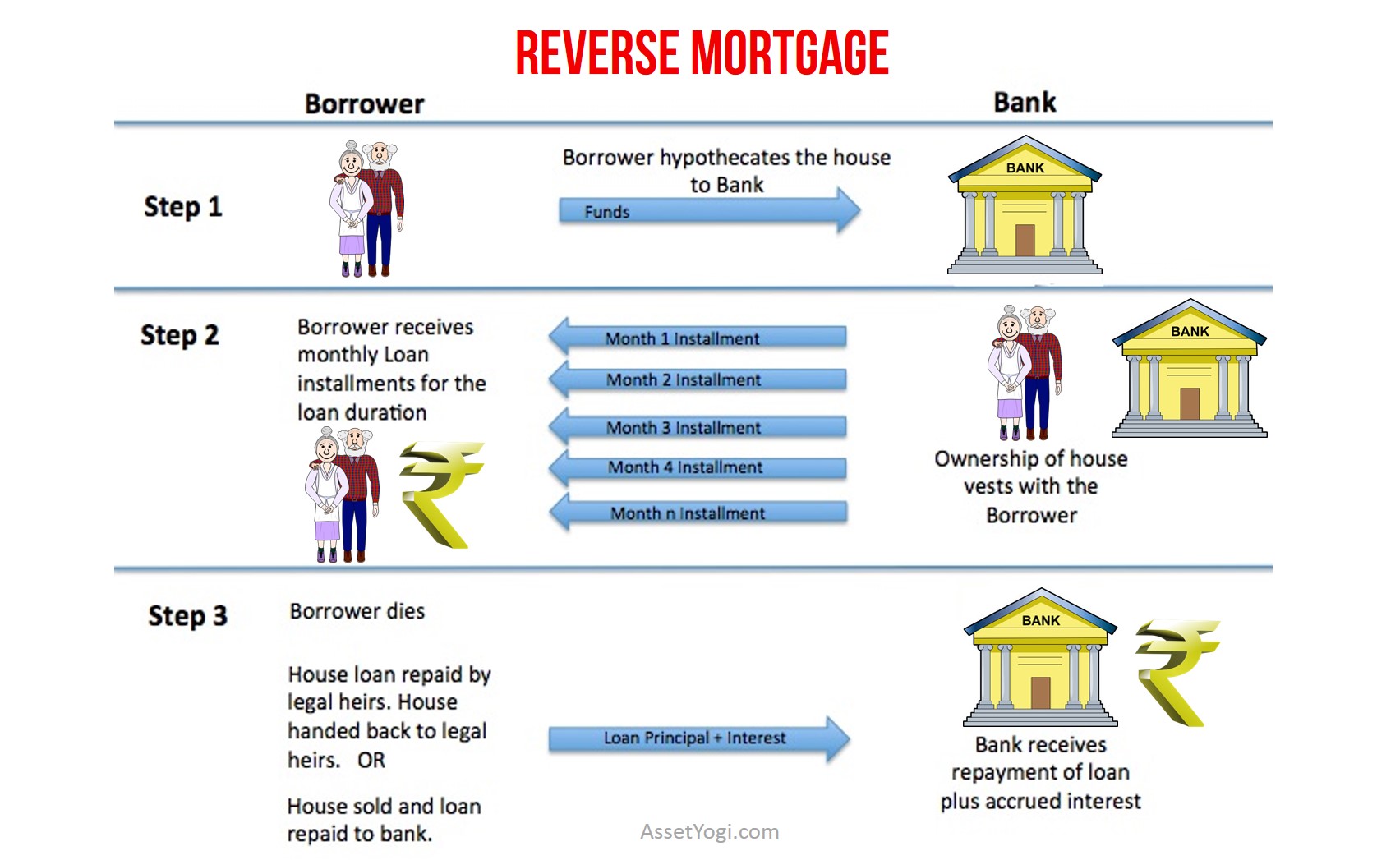

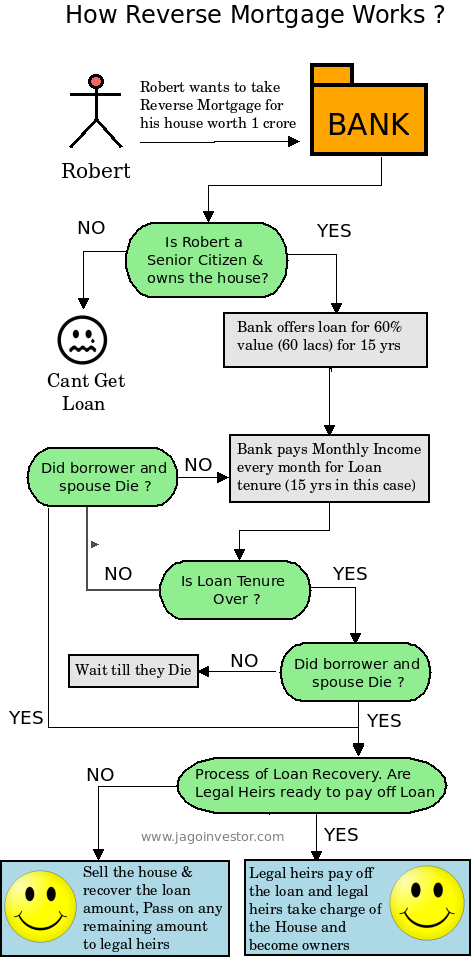

How to settle a reverse mortgage. Prospective borrowers carrying delinquent tax debt also have the option to repay the debt out. In either case mentioned above its a good idea to speak with a Reverse Mortgage Specialist or housing counselor about your options. 1 settle the mortgage with their own funds and keep the house 2 sell the house and use the proceeds to settle the mortgage or 3 relinquish the house to the bank ie.

To be eligible for a reverse mortgage these prospective borrowers will be required to make timely payments on that repayment plan for at least three months. Hand the house over to the lender. For a reverse mortgage the appraisal must be completed by an Federal Housing Administration FHA approved appraiser and carried out using a sales comparable approach.

Though a reverse mortgage is a good way to use your home to access money another less risky option to consider in this regard is to borrow against your home. If I currently have a reverse mortgage and remarry can I simply add my spouse to my reverse mortgage loan. 24 Refinance Your Reverse Mortgage.

If the borrower has had an appraisal in the past it typically does not meet the guidelines specific to a reverse mortgage. However depending on the lender and the terms of the loan youll likely have up to six months to repay the reverse mortgage loan. So if you wish to pay off the loan early one method of doing this is to sell the home and use the proceeds from the sale to settle your reverse mortgage debt.

As the debt level rises the settlement will need to contain asset provisions for the person leaving the residence to be divided 5050. Close the Sale and Settle the Loan Once your home sells the proceeds are used to pay off your loan balance and any outstanding fees. Settling the Loan Account.

The formula for determining your down payment says you need a 50 loan-to-value ratio or 50000 to get a HECM for Purchase reverse mortgage on the home you want to buy. Technically repayment of the reverse mortgage is due immediately when a maturity event is triggered say when the borrower sells the house moves into an assisted care facility or passes away. Settling the Loan Account - Reverse Mortgage.

The options for the reverse mortgage after death include. That means you will need a loan of 50000 to complete the purchase. Generally youre required to pay off your reverse.

If the owner passes away the heirs have three options. 2 How to Get Out of a Reverse Mortgage. Based on this value the bank will decide the maximum amount you can receive as a loan using your property.

21 Sell Your Home and Repay the Lender. May take up to 15 seconds By using ARLO Calculator and clicking on the View ARLO Analysis Nowbutton above you consent acknowledge and agree to the following. The short answer is no.

You could add your spouse to your homes title potentially making it easier for your spouse to settle your affairs after your passing but you cant add the spouse to the loan. The best initial step is for heirs to take the most recent reverse mortgage statement the borrower received from the lender and review the outstanding balance on the. Some borrowers choose to repay the interest each month to keep the mortgage balance from amortizing negatively.

With a home equity loan you borrow a lump sum and pay it back over time with interest. If your goal is ensure your. A way to do this is to calculate the interest plus the mortgage insurance for the year and divide the amount by 12 months.

As you can see from the examples above it is fairly simple to use a reverse mortgage to settle a divorce when one has a free and clear home. Pay the loan balance in full this could be done thru refinancing existing assets or selling the property and keeping any remaining home equity Walk away from the home which would result in a foreclosure action by the servicer. How the loan balance may change as time passes.

You can do so via a home equity loan or a home equity line of credit or HELOC. The bank will send a valuator to inspect your property and determine its value. Suppose you have a residential property that you want to use as collateral to obtain a Reverse Mortgage Loan from a bank.

As mentioned above heirs do not. 23 Take Out a Conventional Loan to Pay Off the Reverse Mortgage. When the last surviving borrower sells or conveys title of the property passes away or does not maintain the property as a principal residence for a period exceeding 12 months due to physical or mental illness the loan has reached what is called a maturity event.

The HECM for Purchase reverse mortgage provides that at 5 interest. While there are several types of reverse mortgages including those offered by private lenders they generally share the. 22 Take Out a Conventional Mortgage to Pay Off the Reverse Mortgage.

In order to obtain a reverse home mortgage you need to go to the really the very least 62 years old remaining in the a home that you have without premium residence mortgage or occasionally with a percent of house mortgage remaining to be that can be exercised with the cash money acquired from the reverse financing. Retirement finances can be tricky so its a good idea to get all the perspective and education that you. Calculating Your Reverse Mortgage Options.

What Is A Reverse Mortgage And How Does It Work

Reverse Mortgage Guide On Reverse Mortgage Loan Scheme Assetyogi

How To Sell A Home That Has A Reverse Mortgage Forbes Advisor

Reverse Mortgage Problems Myths And Truths Homeequity Bank

What Is A Reverse Mortgage Market Business News

How To Use A Reverse Mortgage In A Divorce Settlement

What Is A Reverse Mortgage And How Does It Work Money

What Is Reverse Mortgage And How It Works

Reverse Mortgage Loan Enabled Annuity Rmlea A Better Option Over Reverse Mortgage Loan Rml Mymoneysage Blog

Reverse Mortgages And Estate Planning Lendingtree

Reverse Mortgage Does It Work For You Silver Talkies

How Technology Is Changing How We Treat Residential Mortgage Help Earn Money Paypal Hitting Advertisements Best Blog 2643

Reverse Mortgage Foreclosure Lendingtree

Reverse Mortgage The Bank Pays You The Emi Forbes India

The world of rules can appear to be a bowl of alphabet soup at times. US money laundering rules are not any exception. Now we have compiled an inventory of the top ten cash laundering acronyms and their definitions. TMP Risk is consulting agency focused on defending financial services by decreasing threat, fraud and losses. We have large bank expertise in operational and regulatory danger. We have now a robust background in program management, regulatory and operational threat as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many adversarial penalties to the group due to the dangers it presents. It will increase the probability of major risks and the opportunity cost of the financial institution and in the end causes the bank to face losses.

Comments

Post a Comment