- Get link

- Other Apps

- Get link

- Other Apps

The idea of cash laundering is very important to be understood for those working in the monetary sector. It's a process by which dirty cash is transformed into clean money. The sources of the cash in actual are criminal and the cash is invested in a method that makes it look like clean money and conceal the identity of the felony part of the money earned.

While executing the monetary transactions and establishing relationship with the new clients or maintaining present customers the duty of adopting sufficient measures lie on each one who is a part of the organization. The identification of such factor at first is straightforward to cope with instead realizing and encountering such situations afterward within the transaction stage. The central bank in any nation supplies complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously present sufficient security to the banks to deter such situations.

High Risk Products Some banking products are considered higher risk and thus require enhanced checks. Money laundering underpins and enables most forms of organised crime allowing crime groups to further their operations and conceal their assets.

Eu Policy On High Risk Third Countries European Commission

Tailored telegraphic transfer software.

Key money laundering risk. Monitoring Real-Time Transactions is a Key Method. Globally governments have narrowed key risk indicators to five primary divisions of 1 Nature size and complexity of a business 2 Customer types including B2B and B2C 3 the types of products and services provided to customers 4 method of on-boarding new customers and ongoing communications with existing customers and finally 5. Money Laundering Risk in Banking Institution The Financial Action Task Force on Money Laundering FATF which is recognized as the international standard setter for anti-money laundering efforts defines the term money laundering as âœthe processing of criminal proceeds to disguise their illegal originâ in order to legitimize the ill-gotten gains of crime.

The risk of non-face to face identification due to digital on-boarding. The European Banking Authority EBA today published its biennial Opinion on risks of money laundering. Increased activities of non-profit organisations in countries with a higher risk of money laundering or terrorist financing.

The NRA sets out the key money laundering and terrorist financing risks for the UK how these have changed since the UKs first NRA was published in 2015 and the action taken since 2015 to. 11 March 2021 The FATFEgmont report on trade-based money laundering risk indicators will help the public and private sector identify suspicious activity in international trade. Money Laundering Risk Protect the organization against criminals using the organization to launder proceeds of crime Key question - Where did the money come from.

The EBA highlights key money laundering and terrorist financing risks across the EU 03 March 2021 The MLTF risks identified by the EBA include those that are applicable to the entire financial system for instance the use of innovative financial services while others affect specific sectors such. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Money Laundering Risk vs.

With these efforts in place backline risk managers can utilize professional tools to assess the risks for money laundering and formulate specific control measures based on this information. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. The paper also focuses on other aspects that are relating to the topic question.

The money laundering risk base approach and its key components All parts of the question can be answered in relation to a jurisdiction with. Key money laundering and terrorist financing risks across the EU ECIIA The European Banking Authority EBA published its biennial Opinion on risks of money laundering and terrorist financing MLTF affecting the European Unions financial sector. EBA highlights key money laundering and terrorist financing risks across the EU.

Controls may be weakened by disjointed processes and remote handovers. Country Risk This usually includes an initial assessment of. This is a paper that focuses on the money laundering risk base approach and its key components.

Trade-based money laundering is one of the most complex and widely used methods of money laundering. Key challenges faced. Credit Risk Credit Risk Protect the organization against financial losses Key question - Is the money there.

The latest risk outlook has just been published by the Accountancy AML Supervisors Group AASG and covers key money laundering risk areas as well as terrorist financing risk areas threatening the. What are the key risk indicators for money laundering. A customer money laundering risk rating should be properly applied.

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

Difference Between Kyc And Aml Tookitaki Tookitaki

Anti Money Laundering Aml Risk Assessment Process

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Key Component Of Aml Anti Money Laundering Compliance Program Plianced Inc

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

Financial Crime Risk Assessment Acams Today

Anti Money Laundering And Counter Terrorism Financing

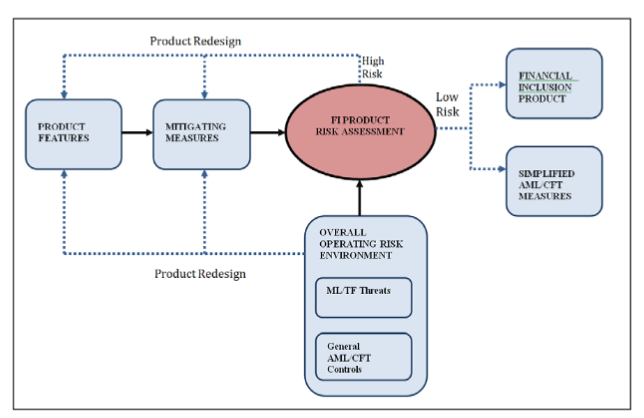

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation

Methodology And Data Basel Institute On Governance

An Introduction To The 360 Degree Aml Investigation Model Acams Today

Anti Money Laundering Aml Risk Assessment Process

The world of regulations can look like a bowl of alphabet soup at occasions. US money laundering laws aren't any exception. We've compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting agency focused on defending financial providers by decreasing threat, fraud and losses. We've got massive bank expertise in operational and regulatory threat. We've a powerful background in program management, regulatory and operational risk in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many opposed consequences to the group as a result of risks it presents. It increases the probability of major dangers and the opportunity cost of the bank and ultimately causes the financial institution to face losses.

Comments

Post a Comment